Bajaj Finserv endeavours to be a financial services lifecycle partner to every Indian.

Sanjiv Bajaj

Chairman & Managing Director

Tapan Singhel

Managing Director and CEO

Bajaj Allianz General

Insurance Co. Ltd.

Anish Amin

President Group Risk,

Assurance & Human Resource

Bajaj Finserv Ltd.

Tarun Chugh

Managing Director and CEO

Bajaj Allianz Life Insurance

Co. Ltd.

Sanjiv Bajaj

Chairman and Managing

Director,

Bajaj Finserv Ltd.

Devang Mody

Whole Time Director and CEO

Bajaj Finserv Health Ltd.

Sam Subramaniam

President Private Equity,

Investments & Group Strategy

Bajaj Finserv Ltd.

Ganesh Mohan

Whole Time Director and CEO

Bajaj Finserv Asset

Management Ltd.

S Sreenivasan

Chief Financial Officer,

Bajaj

Finserv Ltd.

Rajeev Jain

Managing Director

Bajaj Finance Ltd.

V Rajagopalan

President (Legal and Taxation)

Bajaj Finserv Ltd.

Dr. N Srinivasa Rao

Chief Economist and President

(Corporate Affairs)

Bajaj Finserv Ltd.

Kurush Irani

President (CSR)

Bajaj Finserv Ltd.

Ashish Panchal

Whole Time Director and CEO

Bajaj Finserv Direct Ltd.

Anup Saha

Deputy Managing Director

Bajaj Finance Ltd.

Purav Jhaveri

President (Investments),

Bajaj Finserv Ltd.

Manish Jain

Managing Director,

Bajaj

Financial Securities Ltd.

Atul Jain

Managing Director

Bajaj Housing Finance Ltd.

At Bajaj Finserv, we are committed to making our nation financially resilient and strong. By actively contributing to financial inclusion, employability, social betterment and the environment.

Bajaj Finserv has been an enthusiastic participant in the digital revolution sweeping India.

1 in 7 Indians is our valued customer, making Bajaj Finserv a one-stop integrated solution for financial well-being of a billion-strong nation.

0+

Financial solutions

0 Locations

Customers served

0+ million

Customers served

0 +

Insurance agents of BALIC and BAGIC

Solutions

for Everyday

Life

- Bajaj Finserv Health App

- Life Insurance

- Health Insurance

- Retirement and Pension Plans

- Consumer Durable Loans

- SME loans

- Commerical lending

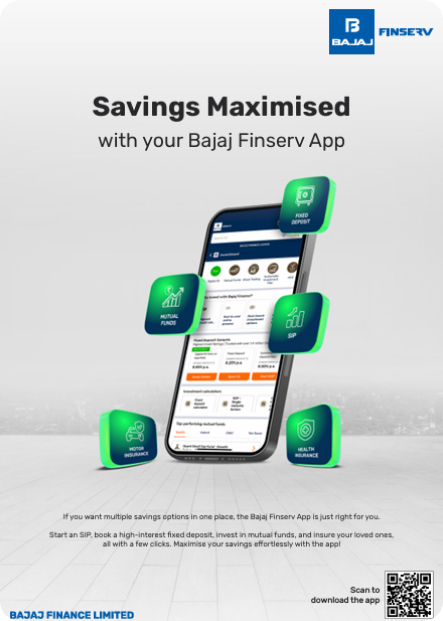

- Systematic Investment Plans

- Rural Loans

- Motor Insurance

- Two-Wheeler Loans

- Car Loans

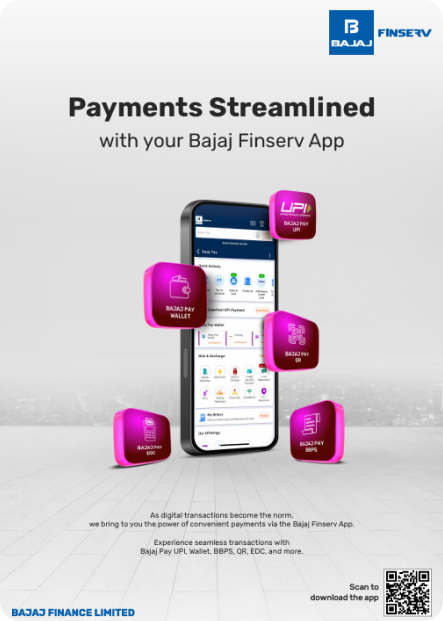

- Bajaj Finserv App Payments

- Broking and investment services

- Mutual Funds

- Pocket Insurance

- Business Loans

- Child Plans

- Home Loans

- Fixed Deposits

- Personal Loans

- Gold Loans

- Travel Insurance

- Education Loans

- Personal Accident Insurance

- Home Insurance

- Home Renovation Loans

- Pet Insurance

A place where innovation, agility and ownership thrive,

creating responsible leaders who build long-term

profitable

businesses, to

delight our customers

Diversified, agile, and continuously transforming through innovation

Financing, Deposits, Investments

Bajaj Finance

Leading NBFC with an optimal mix of risk and sustainable profits. Committed to continuous tech-led innovation. Uses digitalisation and analytics to transform customer experience.

Protection

Bajaj Allianz General Insurance Company

Leading and profitable private insurer with strong underwriting, product innovation, driven by technology, strives to be the best claims-paying general and health insurer.

Life Goals

Bajaj Allianz Life Insurance Company

One of India’s fastest-growing private life insurers offering seamless, simplified and personalised experiences.

Digital Financial Marketplace

Bajaj Finserv Direct

Digital marketplace for financial services; cloud based digital native architecture leveraging API ecosystem, Big Data, modern web and app technologies. It’s Technology Services offers Digital Application Development, Enterprise Solution Development, Data Engineering, Analytics, Quality Assurances & Automation and Managed Cloud Services.

Home Finance

Bajaj Housing Finance

Amongst the fastest-growing home finance companies with a full range of mortgage products with customised propositions for self-employed and salaried customers.

Mutual Funds

Bajaj Finserv Asset Management

Aims to be a full stack AMC with active and passive products, across debt, equity and hybrid, for retail, HNI and institutional investors with a unique behavioural financebased investment philosophy.

Health-tech

Bajaj Finserv Health

A digital platform that integrates the fragmented healthcare delivery ecosystem. Offers products and services to individuals and corporates, from preventive to prepaid healthcare packages including OPD care, and telemedicine.

Digital Stockbroker

Bajaj Financial Securities

All-in-one digital platform combining demat, broking, margin trade financing for retail and HNI clients.

FY2024 was a remarkable year for the Bajaj Finserv group, with strong growth and

performance across our businesses. Here are some key highlights:

`10 crore

Bajaj Finserv’s consolidated total income

`0 crore

Bajaj Finserv’s consolidated profit after tax

`00 crore

Bajaj Finance’s consolidated Assets Under Management

`0 crore

Bajaj Allianz General Insurance’s Gross Written Premium (GWP)

`0 crore

Bajaj Allianz Life Insurance’s Individual Rated New Business (IRNB)

FY2024 saw our businesses achieve significant scale and set new benchmarks.

Bajaj Finserv

Consolidated revenue crossed

` 1 lakh crore

(` 1 trillion)

Bajaj Finance

Assets Under Management crossed

` 330,000 crore

Bajaj Allianz General Insurance (BAGIC)

Emerged as the third-largest insurer with gross written premiums exceeding ` 20,000 crore

Bajaj Allianz Life Insurance (BALIC)

Continued to be the fastest-growing

life insurer; Assets Under Management

crossed ` 1 lakh crore (` 1 trillion)

Bajaj Housing Finance (BHFL)

Emerged as one of the leading home loan

companies closing with an

AUM exceeding

` 90,000 crore

Bajaj Finserv Asset Management

Garnered over ` 9,500 crore of assets in nine months

Bajaj Finserv Direct

Bajaj Technology Services offers digital-first solutions for BFSI businesses in 6 key areas: Adobe, SalesForce, Cloud, Gen AI, Data Analytics and Digital agency

Bajaj Finserv Health

Completed acquisition of Vidal Healthcare and with a full stack of Outpatient, Hospitalisation and Wellness services delivered digitally; now has the capability to participate in India’s healthcare revolution

For 17 years, our businesses have evolved to cater to financial lifecycle needs of

customers and to deliver value to stakeholders.

Total Income (₹ in crore)

Financial Year

Net Worth / Equity (₹ in crore)

Financial Year

Profit After Tax (₹ in crore)

Financial Year

All figures till FY2017 are as per previous GAAP.

All figures from FY2018

onwards are as per

Ind AS.

Accelerating Momentum of Youth Skilling

Skilling has been central to our social impact programmes. It has a multiplier effect on the well-being of youth and their families.

Enabling Holistic Development of Children and Youth

Protecting and enhancing the well-being of children is central to our social impact programmes.

00

Children benefitted from digital learning interventions, foundational learning & other educational initiatives

10

Persons with disabilities benefitted from rehabilitation, education, medical and infrastructure support

0 lakh

Beneficiaries of projects for skilling, child health, education, protection and PwD, promoting the well-being of future generations

0 +

Women empowered through various skilling initiatives aimed at promoting gender equality and women's economic participation