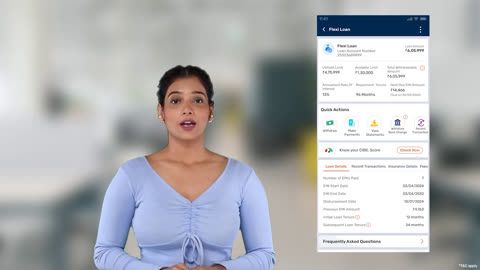

Manage your loan EMIs on our service portal

When you take a loan, you repay the amount over a defined period of time. The part of the loan you repay every month is called an instalment or an EMI (equated monthly instalment). If you opt for a Term Loan, your EMI consists of the principal, which is the amount you have borrowed, and the interest charged on it. However, if you have chosen one of our Flexi variants, the instalment may contain only interest or both interest and principal.

Your EMIs are defined at the beginning of the loan tenure. And the instalment is deducted from your bank account on a fixed date every month. You also have several other options that you can use for the repayment of the loan. These include paying an EMI in advance, part-prepaying and foreclosing your loan.

Visit our service portal and explore our loan repayment options, such as:

-

Overdue EMIs

If you miss a loan EMI or have an instalment that you were unable to clear in time, you can visit the service portal and complete your overdue payment.

-

Advance EMI

Pay an EMI in advance to avoid bounce charges. This will also help you maintain your CIBIL Score.

-

Part-prepayment

Pay back a part of your loan before time. You can complete your loan tenure sooner and save on interest.

-

Foreclosure

Pay off the entire outstanding loan amount in one go.

Clear your overdue EMIs

Usually, your loan EMIs get automatically deducted from your bank account on the due date. However, in the rare possibility of a technical issue or if you do not maintain sufficient funds in the service portal, your EMI could remain unpaid. Such unpaid instalment is called an overdue EMI.

Overdue instalments can adversely affect your credit score and make it harder for you to get loans in the future. Besides this, you will also need to pay an additional fee or charges known as penal interest.

If you have missed a loan EMI, it is important to clear it as quickly as possible. You can manage all your overdue EMIs for loans taken from Bajaj Finserv by visitingthe service portal.

-

Overdue payment

You can pay your overdue EMIs in the service portal by following these simple steps:

- Click on the ‘Sign-in’ button on this page.

- Enter your mobile number, date of birth and submit the OTP.

- Go to ‘Home’ and click on ‘Pay EMIs’

- Select your loan account number and click on ‘Proceed’

- Scroll to the ‘Missed instalments/ other overdues’ tab

- Enter the amount you want to pay and click on ‘Proceed To Payment'

- Select your preferred payment mode and click on ‘Pay Now’

You can also pay your overdue instalment by clicking on the ‘Clear your overdue EMI’ option below. You will be redirected to the payment section, where you can select your loan account, click on ‘Missed instalments/ other overdues’ from the list of options, and proceed with payment.

-

Manage your loan EMIs

Choose from multiple payment options and repay your loan easily. Sign-in to the service portal to begin.

Pay your EMIs in advance

For most loans, the instalment amount remains fixed over the repayment tenure. A set amount gets deducted from your bank account on a fixed date. If you have surplus funds at some point over the loan tenure, you may choose to pay off an EMI before the due date.

If advance payment is made 4 days before the due date of the ongoing month, your EMI will automatically get adjusted towards your instalment for the next month. This means that your EMI will not be deducted from your bank account next month.

You may choose the advance EMI option if you fear missing your due date, have issues with your bank account registration or any such instances. In fact, you can choose from several modes of payment to make an advance EMI. This will ensure that your EMI is paid ahead of time, and you avoid any penal charges applicable and any negative impact on your credit score in the case of missed EMIs.

With the service portal you can pay one EMI in advance if you have opted for our Flexi Loan variant and up to five EMIs if you have chosen a regular Term Loan.

Note: Advance EMI cannot be treated as part-prepayment or foreclosure of the loan(s) irrespective of the loan variant availed or the amount paid by you and hence no interest is payable by BFL on the advance EMI or no interest benefit by treating advance EMI amount as part payment will be given in the loan.

-

Advance EMI payments

You can pay your loan EMIs in advance in the service portal by following these simple steps:

- Go to our service portal by clicking on ‘Sign-in’ button on this page.

- Enter your mobile number, date of birth and verify your details with an OTP.

- Go to ‘Home’ and click on ‘Pay EMIs’

- Select your loan account number and click on ‘Proceed’

- Scroll to the ‘Advance EMI’ tab

- Select the month for which you wish to make payment and click on ‘Proceed to payment’

- Select your preferred payment mode and click on ‘Pay now’

You can also pay an EMI in advance by clicking on the ‘Pay your EMI in advance’ option below. You will be asked to sign-in to the service portal. Once signed-in, you can choose the loan account, select ‘Advance EMI’ option and proceed with payment.

- Go to our service portal by clicking on ‘Sign-in’ button on this page.

Benefits of making part prepayments

00:32

00:32

Part-prepay your loan

If you have surplus funds, you can pay back a part of your loan amount ahead of schedule. This means that interest is charged only on the remaining amount due – which in-turn reduces your loan tenure and/or the EMI.

-

Repay a part of your loan in advance

You can part-prepay your loan amount in just a few simple steps by visiting our service portal.

- Sign-in to the service portal with your mobile number and date of birth.

- Go to ‘Service’ and click on ‘Relations’.

- Select your loan account number.

- Click on ‘Make loan payments’.

- Select ‘Part-prepayment’ and click on ‘Continue’.

- Enter the amount and review the applicable charges.

- Select your preferred payment mode and click on ‘Pay now’.

Foreclose your loan

Depending on the additional funds you have, you may choose to pay off the entire outstanding loan amount in one go. This is called loan foreclosure or full pre-payment of loan.

Foreclosing your loan can help you save on interest payments and reduce the overall cost of your loan.

Before you decide to foreclose your loan, it is important to carefully evaluate the terms and conditions as well as the additional charges applicable for the foreclosure of the loan.

-

Repay your entire loan amount in advance

You can foreclose any of your loans in account by following these simple steps:

- Sign-in to our service portal with date of birth, mobile number and OTP.

- Go to ‘Home’ and click on ‘Pay EMIs’.

- Select your loan account number and click on ‘Proceed’.

- Scroll to the ‘Full payment/ foreclosure’ tab.

- Review the applicable foreclosure charges and proceed with the payment.

You can also close your loan by clicking on the ‘Foreclose your loan’ option below. You can sign-in to the service section select your loan account, click on the ‘Foreclosure’ option, and proceed with payment.

Foreclose your loan - Sign-in to our service portal with date of birth, mobile number and OTP.

Frequently asked questions

An advance EMI refers to the payment of an EMI in advance, i.e., before the due date. This amount gets adjusted toward your upcoming EMI. However, your advance EMI payment should be made 4 days before the payment due date.

Advance EMI payments made in less than 4 days remaining for due date will get adjusted in the subsequent month’s EMI.

Pay your EMI in advance

You will need to clear all bounce/ overdue charges before foreclosing your loan. When you apply for a loan foreclosure, you can check all overdue charges on your loan account and pay them.

There are no foreclosure charges applicable to consumer durable loans and those availed using your Insta EMI Card.

However, for business loans, professional loans, and personal loans, foreclosure charges are applicable. You can click here to check the complete list of fees and charges.

No, not at all. Once you foreclose a loan, the same will be reported to CIBIL as 'Closed' along with 'Zero’ outstanding.

When you borrow a loan, you usually repay it in equated monthly instalments (EMIs). This monthly instalment usually consists of principal and the interest amount. However, you have other options to manage your loan repayment. If you have an ongoing loan with Bajaj Finance, you can explore these payment options on our service portal

Advance EMI payment: With this facility, you can pay your monthly instalment before its due date. If you have a Term Loan with us, you have the option to pay up to five EMIs in advance. However, in case you have a Flexi Loan, you can pay only one EMI in advance.

Part-prepayment: If you have surplus funds, you can use this option to pay a part of your outstanding loan ahead of the schedule. Part-prepaying your loan will help you in either lowering your EMI or reducing the overall tenure.

Foreclosure: With this option, you can close your loan early by paying the entire outstanding amount in one go. Foreclosing your loan will help you become debt-free faster.

Yes, you can pay your Bajaj EMI without logging into the customer portal by using payment links sent via SMS/email, or by visiting the Bajaj Finserv payments page. You can also use third-party platforms or UPI apps to complete EMI payments easily.

Bajaj Finance charges a penal interest of up to 4% per month on the overdue EMI amount. This is calculated from the due date until the actual payment date. Additional bounce charges or reminder fees may also apply if payments are delayed or missed.

To check your Bajaj EMI payment history, log in to the Bajaj Finserv customer portal or app. Navigate to your loan details and select the payment history or statement option to view past EMI transactions, due dates, and outstanding amounts.

Bajaj Finance typically does not offer a formal grace period. EMIs must be paid on or before the due date to avoid penal charges. However, in rare cases, borrowers can contact customer support for temporary relief based on genuine hardship.

You cannot change your EMI date once the loan has been disbursed. The EMI date is fixed at the time of loan agreement. If you wish to align payments with your salary cycle, consider this when selecting your loan start date.

You can activate auto-debit by submitting an e-NACH mandate during loan disbursal or via the Bajaj Finserv customer portal. Ensure your bank account has sufficient funds and is linked correctly to avoid EMI bounce and related penalties.

Yes, Bajaj Finance accepts EMI payments via UPI. You can pay using any UPI-enabled app by entering the Virtual Payment Address (VPA) or scanning the QR code provided in payment communication or on the Bajaj Finserv website.

Missing two EMIs can lead to higher penal interest, negative impact on your CIBIL score, and potential recovery actions. It may also result in legal notices or asset repossession in secured loans. Prompt repayment or reaching out to Bajaj Finance is advised.

Log in to the Bajaj Finserv customer portal or app, select your loan, and click on the ‘Download Receipt’ option under the payment section. You can download and save or email the EMI payment receipt for your records.

Yes, you can prepay your Bajaj loan EMI online through the Bajaj Finserv customer portal or app. Choose your loan, select ‘Part-payment’ or ‘Foreclosure’ as required, and pay using UPI, net banking, or a debit card to complete the transaction.