Why get the Insta EMI card?

00:34

00:34

Eligibility criteria on to apply for Bajaj Finserv Insta EMI Card

To apply for the Insta EMI Card, you must meet some basic eligibility requirements, including:

- Indian nationality

- Age between 21 – 65 years

- Regular income source

- Credit score as per risk policies

Check Also: Documents Required for Insta EMI Card

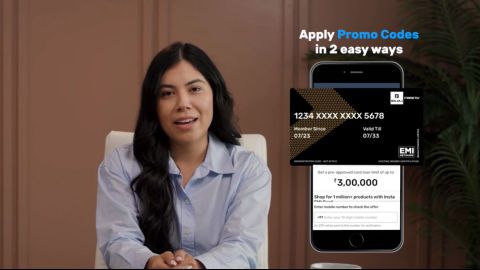

Depending on your eligibility, you might qualify for a Bajaj Finserv Insta EMI Card limit of up to Rs. 3 lakh as a pre-qualified card loan offer amount. Enter your mobile number and OTP to check your eligibility now!

Frequently asked questions

No documentation submission is required when you have your Bajaj Finserv Insta EMI Card. Simply authenticate your purchase with the OTP sent to your registered mobile number, and you're good to go.

You can use the Insta EMI Card to shop from merchants across various other 1.5 LAKH online and offline partner stores like

- Amazon

- Flipkart

- Croma Store

- Home Centre

- Poorvika Mobiles

- Sangeetha Mobiles

- MakeMyTrip

- Easemytrip

- Goibibo

- Unacdamey

- Godrej

- OnePlus

- Flo Mattress

- realme

- Voltas

Approval for the Bajaj Finserv Insta EMI Card is instant upon successful application and verification, allowing immediate use for shopping.

The Insta EMI Card is not free. It comes with a one-time joining fee of ₹530 (inclusive of applicable taxes).

A reliable repayment history and a good CIBIL Score per Bajaj Finserv risk policies are required for approval.

Your Insta EMI Card may be blocked due to missed payments, poor credit history, or failure to meet eligibility criteria.

To improve your eligibility, ensure a stable income, maintain a good credit score, and provide accurate details during application.