Understanding EMI Bank account details for your car loan

Your Equated Monthly Instalment (EMI) payments for a car loan are linked to a specific bank account from which the amount is deducted every month. Keeping your EMI bank account details updated is crucial to ensuring timely payments, avoiding penalties, and maintaining a good credit score.There are several reasons why you might need to change your EMI bank account details, such as switching to a new salary account, closing your existing bank account, or opting for a more convenient payment method. Failing to update your account details on time can lead to missed payments, late fees, and even a negative impact on your creditworthiness.

Understanding when and why to update your EMI bank account details helps ensure a hassle-free repayment process. Read on to explore the key reasons why changing your EMI bank account details for a car loan might be necessary and how it can benefit you.

Why change your EMI bank account details for a car loan?

Switching to a new salary accountIf your employer changes your salary account to a different bank, updating EMI details prevents payment failures.

Ensures funds are available in the linked account when the EMI is deducted.

Closing or deactivating your current account

If your existing bank account is closed, frozen, or inactive, EMI payments may bounce.

Updating details to an active account ensures uninterrupted loan repayments.

Better bank offers & cashback benefits

Some banks offer better auto-debit facilities, cashback, or lower transaction fees on EMI deductions.

Shifting to a more beneficial account can help optimize financial management.

Avoiding overdraft fees & insufficient Balance issues

If your current account has low balance issues, payments may bounce, leading to penalties.

Switching to an account with consistent fund availability ensures hassle-free EMI deductions.

Merging multiple loan payments into one account

Managing multiple EMIs from different accounts can be confusing.

Consolidating payments into a single account simplifies tracking and reduces errors.

Banking convenience & digital access

Some banks offer better digital access, UPI features, or auto-payment options.

Moving to an account with seamless EMI management ensures ease of payment.

Updating your EMI bank account details is essential for smooth loan repayment. Make sure to check your lender’s requirements and update details before the next EMI due date to avoid complications.

Steps to update EMI account information for car loan

Contact your lenderReach out to your car loan provider through customer service, branch visit, or online banking portal.

Request details on the process and required documents for updating EMI account information.

Submit an account change request

Fill out the bank account change request form provided by the lender.

Ensure all details, including the new bank account number and IFSC code, are correctly entered.

Provide necessary documents

Most lenders require the following documents:

A cancelled cheque or bank statement of the new account.

A duly signed request letter for account change.

Identity proof (Aadhaar, PAN, or Passport) for verification.

Verify auto-debit mandate (NACH/ECS Update)

If your EMI is deducted through auto-debit (NACH/ECS mandate), you’ll need to submit a new mandate authorization form.

Some lenders allow digital updates through net banking or mobile apps.

Check for processing fees

Some banks and lenders may charge a processing fee for account updates.

Confirm the charges before proceeding with the change.

Approval & confirmation

The lender will review and process your request, which can take 7-10 working days.

You will receive an SMS or email confirmation once the update is successful.

Ensure sufficient funds in old & new accounts

Keep sufficient balance in the old account until the update is confirmed.

Ensure the new account has funds for EMI deduction from the next billing cycle.

Monitor EMI transactions

After the first EMI deduction from the new account, verify your bank statements to confirm a successful transaction.

Contact your lender immediately if there are any issues.

Common issues while changing EMI bank account details

Delayed processing by lenderAccount updates usually take 7-10 working days but may be delayed due to internal verification.

Follow up with your lender if the process takes longer than expected.

Incorrect account details submitted

Errors in account number or IFSC code can lead to failed EMI deductions.

Always double-check your details before submitting the request.

Rejected auto-debit mandate (NACH/ECS Issues)

If the new bank does not approve auto-debit registration, EMI payments may fail.

Contact your bank to ensure NACH/ECS is activated for EMI deductions.

Pending EMIs in the old account

If there are unpaid EMIs in the old account, the request for change may be rejected.

Clear outstanding payments before updating account details.

Insufficient balance in new account

Ensure the new account has enough balance before the first EMI is deducted.

A bounced EMI can lead to late fees, penalties, and a negative impact on credit score.

Bank-specific restrictions

Some banks have specific conditions for EMI auto-debit.

Check if your new bank supports automatic EMI deductions before switching.

No confirmation received from Lender

If you do not receive a confirmation, contact customer support immediately to verify the status of your request.

Keep all communication records and acknowledgement receipts for reference.

Updating EMI bank account details for a car loan is a simple but crucial process. By following the correct steps and addressing potential issues, you can ensure hassle-free EMI payments and avoid disruptions.

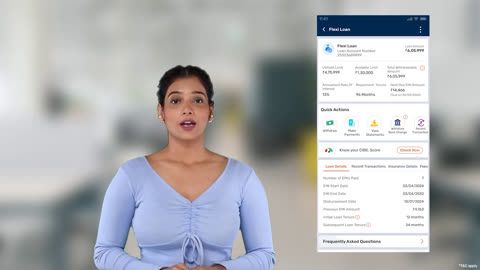

Online process for updating EMI bank account details

Log in to your lender’s portalVisit the official website or mobile app of your lender.

Use your registered mobile number and OTP/password to access your loan account.

Navigate to the EMI account update section

Look for the option labelled "Manage Loan," "Update Bank Details," or "EMI Payment Settings."

Select the option to change the linked bank account for EMI deductions.

Enter new bank account details

Provide the new account number, IFSC code, and bank name.

Ensure the details are accurate to avoid transaction failures.

Upload the required documents

Some lenders require document verification for online updates.

Upload a cancelled cheque, bank statement, and identity proof as per lender requirements.

Authenticate auto-debit mandate (NACH/ECS)

Set up a new NACH/ECS mandate for automatic EMI deductions from the new account.

Authenticate the request using net banking, debit card, or Aadhaar OTP.

Confirm & submit the request

Review the entered details and confirm the submission.

You may receive an SMS or email confirmation upon successful request submission.

Wait for processing & final approval

The bank typically processes the request within 5-10 working days.

Check your loan account or email notifications for approval status.

For more information on car loan management, check out car loan noc online.

Offline process for changing EMI bank account details

Visit the lender’s branchLocate the nearest branch of your car loan provider.

Carry all necessary documents for a smooth process.

Request an account change form

Ask the customer service desk for a "Bank Account Change Request Form."

Fill in the required details, including loan account number and new bank details.

Submit required documents

Attach a cancelled cheque, bank statement, and identity proof with your request form.

Some lenders may require additional documents like a loan agreement copy.

Provide new auto-debit mandate (NACH/ECS Form)

Sign a new ECS/NACH auto-debit authorisation form for EMI deductions from the updated account.

Some lenders may also require your bank’s stamp or verification.

Pay processing fees (If applicable)

Some lenders charge a fee for manual bank account updates.

Check with your lender regarding applicable charges.

Obtain an acknowledgement receipt

After submission, ask for an acknowledgement slip or receipt for future reference.

Follow up on approval status

The update process may take 7-15 working days.

Follow up via customer support or online banking to check the update status.

For more details, visit car loan details.

Documents required for EMI Bank account details update

Identity proof (Any one)Aadhaar Card

PAN Card

Passport

Voter ID

Bank account proof

Cancelled Cheque from the new account

Recent Bank Statement (last 3 months) showing account holder details

Passbook copy with account number and IFSC code

Loan account details

Loan agreement copy (if required by the lender)

Latest EMI payment receipt for verification

NACH/ECS mandate form

A newly signed auto-debit authorization form for EMI deduction from the updated account.

Duly filled account change request form

Available at the lender’s branch or online portal.

Employer Confirmation Letter (If salary account is changing)

If your salary account is changing, some lenders may ask for an employer-issued confirmation letter.

Ensure all documents are accurate and up to date to avoid processing delays.