Understanding the loan settlement process, its advantages and disadvantages, and its impact on financial stability is crucial before opting for it. Lenders usually offer settlements in cases of prolonged non-payment, but it requires proper negotiation and documentation. Borrowers should explore all possible alternatives, such as restructuring the loan, before proceeding with settlement.

In this guide, we will discuss everything about loan settlement, including when it is advisable, how to approach lenders, and its impact on credit history. This knowledge will help borrowers make informed financial decisions and avoid long-term repercussions.

Common reasons for wrong linked accounts in EMI deduction

Incorrect EMI deductions can create financial confusion and missed payments. Below are the key reasons why the wrong account might be linked for EMI deductions and how to prevent such issues.1. Errors in bank details provided

A small mistake in entering bank account details can lead to EMI deductions from the wrong account.Errors may include incorrect account number, IFSC code, or mismatched bank name.

Always double-check the details before submitting them to the lender.

Lenders usually verify bank details, but manual entry mistakes can sometimes go unnoticed.

Ensure the account number provided is active and belongs to you.

2. Changes in business bank accounts

If you have linked a business account for EMI deductions and later change or close it, the EMI may not be deducted properly.Business accounts often undergo structural changes, mergers, or ownership modifications that may impact auto-debit arrangements.

Always update your lender immediately when switching bank accounts.

If your EMI gets deducted from an old or inactive account, request a reversal and ensure the new account is properly linked.

Maintain a buffer balance in both accounts during the transition to avoid failed transactions.

3. Issues from the lender’s side

Sometimes, lenders fail to update the new linked account even after the submission of change requests.Technical errors or delays in processing account updates can lead to deductions from an old or incorrect account.

Always request confirmation from the lender after updating your bank details.

Check your loan account statement regularly to ensure EMI deductions occur from the correct account.

If an issue arises, raise a complaint with customer service and provide proof of the requested change.

By understanding these common issues, borrowers can prevent incorrect EMI deductions and ensure smooth loan repayments without financial disruptions.

Steps to change the linked account for EMI deduction

If you need to change your linked bank account for EMI deductions, follow these essential steps to ensure a smooth transition and avoid payment issues.Step 1: Check lender’s policy on account changes

Every lender has specific guidelines for updating bank account details.Visit the lender’s official website or check your loan agreement for information on account change policies.

Some lenders allow online updates, while others require a branch visit for verification.

Ensure you meet any eligibility criteria, such as having no overdue EMIs.

Step 2: Contact the bank or lender via customer service

Call the lender’s customer care number or visit the nearest branch to initiate the account change request.Explain the reason for updating your EMI deduction account.

Some lenders also offer online chat, email, or mobile app services for such updates.

Request a list of required documents to avoid delays in processing.

Step 3: Submit required documents like a new NACH mandate

Fill out the lender’s account change request form with accurate details.Provide necessary documents, including:

New NACH mandate form (for auto-debit authorization).

Bank proof (cancelled cheque, updated bank statement, or passbook copy).

Identity proof (Aadhaar, PAN, or passport for verification).

Ensure all documents are self-attested and submitted as per the lender’s requirements.

Some lenders may require additional authorisation, such as a signed declaration.

Step 4: Confirm the update and monitor deductions

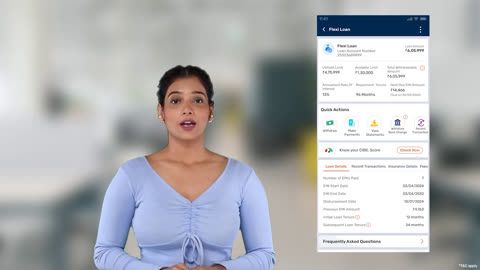

Once the request is processed, confirm the successful account update with the lender.Verify the new linked account details via net banking, mobile banking, or branch confirmation.

Monitor your next EMI payment to ensure deductions occur from the updated account.

If any discrepancies arise, report them immediately to the lender for resolution.

Keep a record of all communications and approval receipts for future reference.

Following these steps will ensure your EMI deductions happen seamlessly from the correct bank account, preventing missed payments or financial disruptions.

Documents required for changing the EMI deduction account

When updating your EMI deduction account, lenders require specific documents for verification. Below is a table detailing the essential documents needed for the process:| Document Type | Purpose | Accepted Formats |

| Account Change Request Form | Formal request to update EMI deduction account | Lender-provided form (filled & signed) |

| New NACH Mandate Form | Authorizes auto-debit from the new account | Signed mandate form (physical/digital) |

| Identity Proof | Verifies borrower’s identity | Aadhaar Card, PAN Card, Passport |

| Bank Account Proof | Confirms new account details | Canceled cheque, Passbook copy, Bank statement |

| Loan Account Details | Ensures correct loan account is updated | Loan agreement copy, Loan account statement |

| Authorisation Letter (if required) | Grants permission for account update | Signed letter from the borrower |

Additional notes:

All documents should be self-attested before submission.Ensure the new bank account is active and operational.

Keep copies of submitted documents for future reference.

Providing complete and accurate documents ensures a smooth and hassle-free account update process.

How long does it take to update the linked account?

The time required to update the linked bank account for EMI deductions depends on various factors, including the lender’s internal processing time and the mode of request submission. Below are key points that explain the timeline and process:1. Standard processing time

Most lenders take 3 to 10 working days to update the linked bank account.Online updates via net banking or mobile apps are generally processed faster (3 to 5 working days).

Manual submissions through branch visits may take longer (up to 10 working days).

2. Factors affecting processing time

Verification of Documents: If the submitted documents are incomplete or incorrect, the process may be delayed.Lender’s Policy: Some lenders have a faster digital approval process, while others require in-person verification.

Bank Authorisation: The new bank account must be authorized for auto-debit through NACH (National Automated Clearing House), which may take additional time.

3. How to track the update status?

Borrowers can track their request through the lender’s customer service, mobile app, or official website.If you have a business loan, you can also check your Bajaj Business Loan Status for updates.

Always request confirmation from the lender after the account update is completed.

4. What to do if the update takes too long?

If the update is delayed beyond 10 working days, contact the lender’s customer service to escalate the issue.Provide proof of submission, such as acknowledgment receipts or email confirmations.

Keep an eye on your Business Loan Statement to ensure the EMI deduction is reflected correctly.

5. Ensuring a smooth transition

To avoid missed payments, initiate the account update at least two weeks before the next EMI due date.Keep funds available in both the old and new accounts until confirmation of the successful update.

Set up SMS or email alerts to monitor EMI deductions from the correct account.

By following these steps and tracking the status proactively, you can ensure a seamless transition without disruptions in your EMI payments.