First-party insurance for two-wheelers, also known as first-party bike insurance, is an indispensable component of responsible bike ownership in India. This comprehensive insurance option provides coverage for your own bike, ensuring you have financial support in the event of accidents, theft, or damage to your two-wheeler. In this comprehensive guide, explore the benefits of first-party bike insurance, the claim process, etc.

First-party insurance for two-wheelers: Overview

First-party bike insurance, often referred to as comprehensive bike insurance, is designed to safeguard the interests of the bike owner. First-party insurance provides an extensive shield for you and your bike. This type of coverage typically includes coverage against various scenarios, such as accidents, theft, vandalism, natural disasters, and more.

First-party bike insurance essentially operates on the principle of 'self-protection’. It covers the damages caused to your own insured vehicle. It ensures that your own financial interests are secure, irrespective of whether the incident was your fault or not. While third-party insurance is a legal requirement in India, opting for first-party insurance is a prudent choice for those who want to secure their two-wheelers.

Benefits of first-party bike insurance

First-party bike insurance offers numerous advantages that make it a wise investment for any bike owner in India. Let us delve into the key benefits of this type of coverage:

Coverage for own damage:

The most significant advantage of first-party insurance is that it covers damage to your own bike. Whether it is a minor scrape, a significant accident, or damage due to natural calamities, your insurance policy will assist in covering the repair or replacement costs.

Theft cover:

First-party bike insurance offers coverage for damages caused due to burglary or robbery. The insurer compensates for the total of the bike.

Accident coverage:

First-party insurance ensures that you have financial support for medical expenses and bike repairs in the event of an accident.

Peace of mind:

Knowing that you have the financial backup in case of any emergency provides you with peace of mind. You can ride with confidence, knowing that you are not financially vulnerable in case of unforeseen incidents.

Customisation options:

You have the flexibility to customise your policy with rider plans or add-on covers. You can avail of add-on covers like zero depreciation cover, roadside assistance cover, NCB protection cover, key replacement cover, etc., which further enhances your coverage.

Legal compliance:

In India, it is mandatory to have at least third-party liability insurance to legally ride a two-wheeler on public roads. First-party insurance meets this requirement while also offering comprehensive coverage for your bike.

Coverage against natural calamities:

First-party insurance also extends coverage to damage caused by natural disasters such as floods, earthquakes, and cyclones. This is especially relevant for locations where the climate can be unpredictable.

How to apply for first-party bike insurance online?

Here’s a step-by-step guide to applying for first-party bike insurance at Bajaj Finance Insurance Mall.

Step 1: Click here to visit our online application form.

Step 2: Fill in the details of your two-wheeler, such as the type, registration number, and PIN code, and click on Get Quote.

Step 3: Choose the IDV, NCB value, optional add-on covers, and plan type for your third-party two-wheeler insurance.

Step 4: Select the owner-driver personal accident cover as mandated by the RTO and proceed to the next step.

Step 5: Confirm the vehicle registration date and previous policy type (Comprehensive/third-party).

Step 6: Provide your personal details such as name, date of birth, residential address, contact number, and previous insurance policy details.

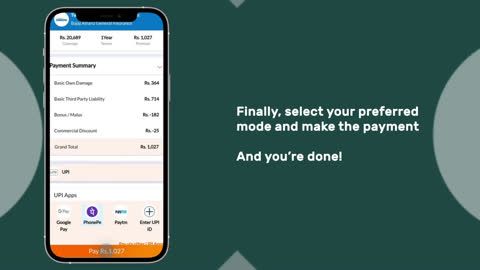

Step 7: Review the details entered and make the payment through your preferred online payment mode.